In the world of financial markets, precision is everything. At Chart-Traders.com, we have refined our strategy to maximize accuracy, efficiency, and risk management. One of the core elements of our CTA+ system is the Blue Box trading area, a key feature that provides high-probability trade setups based on the Phi Formula and Elliott Wave Theory.

Understanding the Blue Box Concept

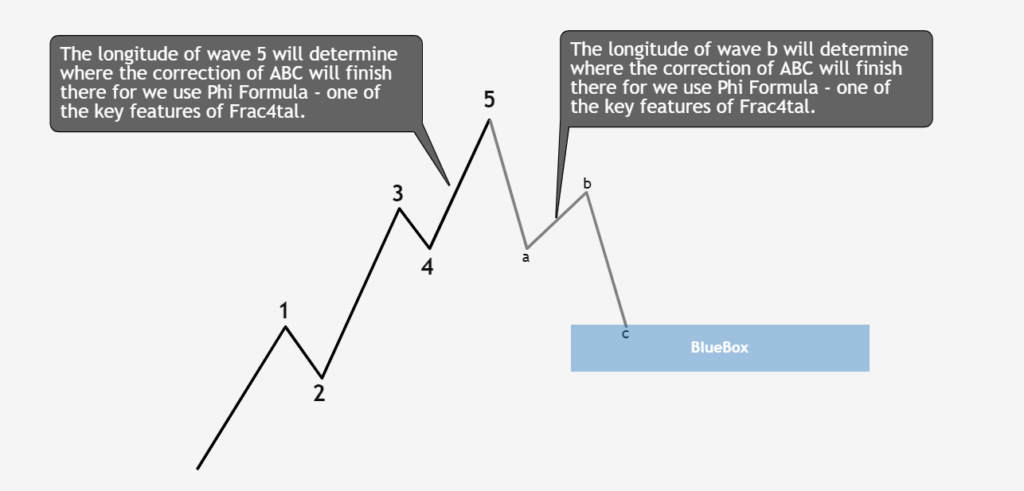

The Blue Box represents a predictive trading zone where we anticipate price action to react with high probability. This area is calculated using Fibonacci extension ratios—commonly 1.618 or 2.618—and is derived from wave structures that align with our Phi-based fractal forecasting method (Frac4tal).

When we share our CTA+ analysis with our subscribers, the Blue Box visually marks the optimal entry zone for a trade. It signals where the market is likely to reverse or continue its trend, based on mathematical projections of wave movements.

Why the Blue Box Works

Markets move in fractal structures, meaning that historical patterns repeat in different scales. By applying Phi Formula calculations, we can identify price clusters where buyers and sellers interact, leading to powerful moves in the anticipated direction.

Two key factors define our Blue Box setups:

- Wave 5 Projection:

- The length of Wave 5 determines where the corrective ABC wave is likely to end.

- This is calculated using the Frac4tal model, applying the formula:where λ is the Fibonacci extension ratio (e.g., 1.618 or 2.618).

- Wave b Projection:

- The length of Wave b influences the final point of correction in an ABC pattern.

- This is determined by:where λ is the Fibonacci extension ratio (e.g., 1.618 or 2.618).

By integrating these calculations, we pinpoint the Blue Box trading area, which acts as a highly reliable decision-making zone for traders.

How to Use the Blue Box in Trading

When a Blue Box appears in our analysis, traders should:

- Wait for price to enter the zone before executing a trade.

- Watch for confirmation signals, such as candlestick patterns or momentum shifts.

- Use appropriate risk management, setting stops just beyond the Blue Box limits.

This method removes emotional bias and ensures traders enter only high-probability setups where the market dynamics align with Phi-based fractal movements.

Conclusion

At Chart-Traders.com, we don’t believe in noisy, speculative trading. Instead, we apply mathematical precision to market forecasting, leveraging the CTA+ system and our Phi Formula to deliver structured, high-probability trades. The Blue Box trading area is one of the most powerful features of our setup, providing traders with a clear, objective strategy to execute profitable trades with confidence.

If you’re ready to trade with precision, not emotion, join us at Chart-Traders.com and experience the Phi-powered way of market analysis!

#TradeWithPhi #PhiFormula #PhiPredict #NoNoiseJustWait