A Strategic Approach to Market Understanding

Unlocking the Power of Elliott Wave Theory: A Strategic Approach to Market Understanding

Welcome to a new section of the blog where we dive into one of the most powerful methodologies for decoding market movements: Elliott Wave Theory. As a market analyst with years of experience across three continents, I’ve seen firsthand how critical it is to not just react to market movements but to understand them at their core. This is where the art of recognizing «reactions» and «actions» comes into play.

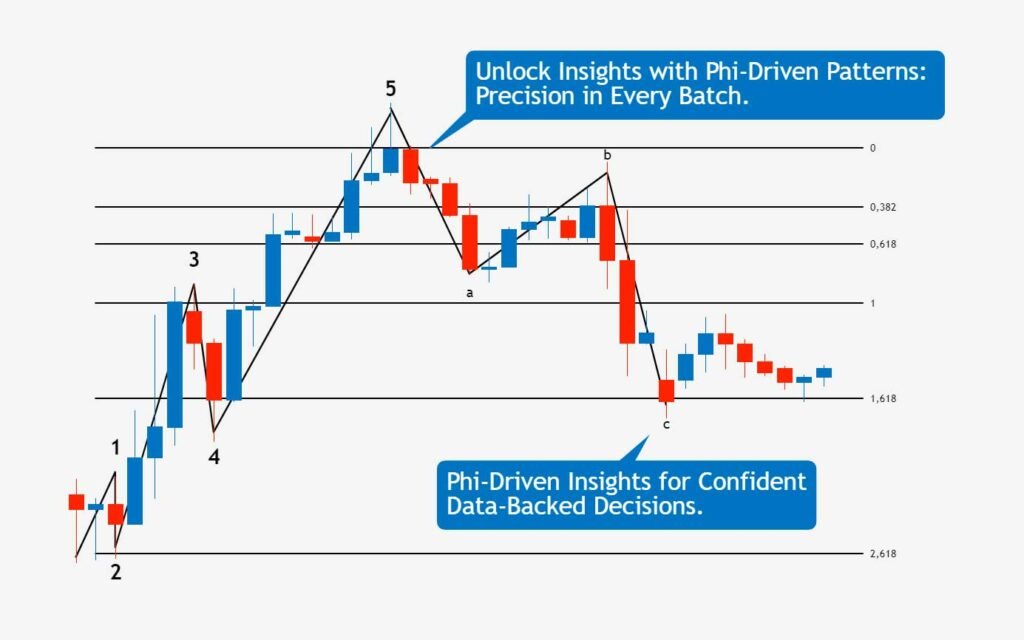

In the stock market, reactions refer to the fluctuations in a stock’s price caused by events or information—an announcement, a shift in sentiment, or a change in the broader economic landscape. These reactions, however, are not random. They often follow specific, predictable patterns. The key to unlocking these patterns lies in the Elliott Wave Theory and, of course, my Phi Formula (φ).

When combined, the Elliott Wave Theory and Phi Formula provide a profound understanding of market psychology. This approach allows us to anticipate future movements and make well-informed decisions, rather than being swept along by the waves of emotion that often dominate the market. This is exactly what I aim to teach you as you join me on this journey from simple observers to confident, strategic players in the financial world.

Understanding the Elliott Wave Theory and Phi Formula

The Elliott Wave Theory has been a staple in market analysis for decades. It uncovers the natural rhythm of market price movements, showing that they are not chaotic, but instead follow a sequence of predictable waves. These waves are based on human psychology—emotion, reaction, and decision-making.

When combined with the Phi Formula (φ)—which integrates the golden ratio and Fibonacci sequences into technical analysis—you get an even more powerful tool. This methodology allows us to categorize different market movements, assigning specific wave patterns that, in essence, guide us through the market’s intricate dance. It’s no surprise that these very patterns are used in machine learning by high-frequency traders in the fintech industry. This intersection of ancient mathematical principles and modern technology is where the true power lies.

By understanding how Elliott Waves and Phi work together, you can begin to predict market movements with greater accuracy. These patterns can be integrated into advanced predictive models, enhancing automated trading systems to anticipate price fluctuations and execute profitable trades.

Navigating the Complexity: Emotions and Market Cycles

But don’t be fooled—while the theory might sound simple, applying it in practice is where the challenge lies. One of the most important aspects of Elliott Wave analysis is understanding the complex environment in which market movements occur. This means looking beyond the numbers and understanding the human emotions driving those movements—greed, fear, and everything in between.

The Elliott Wave Theory isn’t just about recognizing price patterns—it’s also about understanding the emotional cycles at play. As we learn to identify these patterns, we simultaneously embark on a journey of self-awareness. Our emotions influence our decisions more than we realize, and acknowledging this fact is the first step toward making more conscious, strategic choices.

In fact, the market often pushes us to act in certain ways—sometimes to buy at the top, sometimes to sell at the bottom. Understanding the underlying principles of Elliott Waves and how they connect with human psychology can help us stay grounded. Rather than being manipulated by fear or greed, we learn to recognize how collective emotions shape the market and use that knowledge to make informed, rational decisions.

From Reaction to Strategy

In this section, I’ll guide you step by step through the power of Elliott Wave Theory and its integration with the Phi Formula. Together, we’ll learn how to recognize market patterns and manage the emotions that inevitably arise in the process. Over time, you’ll transition from simply reacting to market movements to being a strategic player, capable of anticipating trends and making decisions based on careful analysis rather than knee-jerk reactions.

Stay tuned for more insights and deeper dives into the Elliott Wave Theory, as well as how the Phi Formula adds a new dimension to your trading strategy. This is just the beginning of your transformation into a more informed and strategic investor. Let’s unlock the full potential of the market together.