🔍 Join our exclusive video series for a deeper dive into strategic trading.

🚀 Upgrade to Chart Traders Plus for real-time insights & premium trade setups.

💡

Master Chart Traders:

1.1 What Drives Us

Explore the vision and core principles behind Chart Traders. Learn why we focus on precision, strategy, and the Phi-driven approach to market analysis.

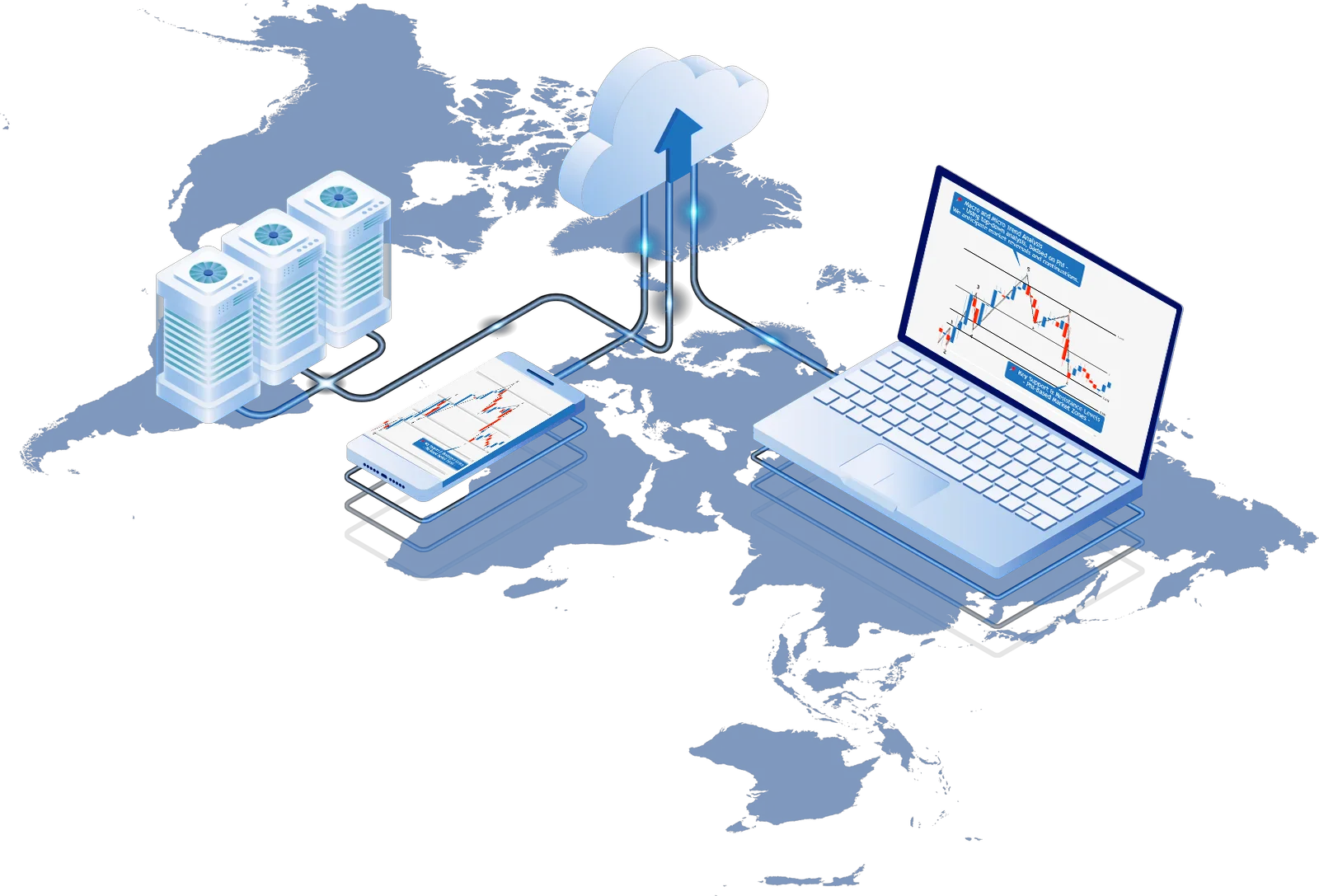

1.2 The Tools We Offer

From free insights to premium analytical tools, discover the full range of resources designed to enhance your trading decisions.

1.3 How to Subscribe

Select a membership plan that fits your trading goals—whether you seek market updates or high-probability trade setups.

1.4 Inside the Trading Room

Gain access to real-time market updates, trade ideas, and expert discussions to refine your strategies.

The Dashboard is where data meets execution. Learn how to navigate, customize, and extract maximum value from it.

2.1 Logging in & Getting Started

Seamlessly access your personalized trading hub.

2.2 Reading & Applying Market Analyses

Decode market trends, price movements, and key reversal zones through structured analyses.

2.3 Leveraging Video Analyses

Get a step-by-step breakdown of how to apply our market insights to your trades.

2.4 Customizing Notifications & Profile Settings

Ensure you receive only the updates that matter, tailored to your trading style.

2.5 Managing Payments & Invoices

Effortlessly handle your subscriptions, transactions, and invoices.

2.6 Subscription Management

Upgrade, modify, or cancel your plan with ease—stay flexible as your trading strategy evolves.

Precision trading starts here—learn how to interpret and apply Chart Traders’ proprietary market forecasts.

3.1 Update Schedules & Accessing the Latest Data

Timing is everything—stay ahead of market shifts by knowing when our forecasts update.

3.2 Mastering Our Charts

Understand trend lines, Fibonacci-based targets, and predictive price structures.

3.3 Primary vs. Alternative Scenarios

Anticipate market direction with probability-based trade setups and scenario planning.

Once you've analyzed the data, it's time to execute with precision.

4.1 Trading the Futures Market

Understand leverage, risk, and reward—and determine if futures fit your strategy.

4.2 Order Types: Limit vs. Direct Execution

Know when to use limit orders vs. market orders for optimal trade execution.

4.3 Position Sizing & Risk Control

Master position sizing strategies to protect capital and maximize returns.

📰 No noise, just facts. Our independent chart insights, based on the Phi formula and Elliott Wave analysis, provide data-driven forecasts—not hype.